The financial sector is witnessing an alarming surge in fraudulent incidents, creating a critical concern for the industry. In 2021 alone, fraud shot up by 70%, causing losses of over $5.8 billion. This troubling trend, paired with emerging threats like AI-based scams, makes it crucial to use the best tools available. In this post, we’ll take a closer look at how Seldon and Effectiv are teaming up to help the financial services industry use artificial intelligence (AI) and machine learning (ML) to tackle fraud prevention and risk.

The Multifaceted Challenges Faced by the Financial Services Industry

The deployment of AI/ML for fraud prevention and risk mitigation creates a set of different challenges for the financial services industry:

- Model Development and Integrity: Crafting, serving, and monitoring models of production caliber demands diligence and expertise, as inaccuracies can lead to consequences such as financial losses or a poor experience for customers.

- Explainability and Model Governance: As the decisions engendered by ML models play a pivotal role in financial transactions, understanding their underlying mechanisms becomes vital. Transparent and interpretable models are fundamental for compliance and risk mitigation.

- Real-Time Decisioning: Batch processing is no longer as useful as it used to be, so we now need instant processing to make sure users have smooth experiences. Today, customers expect fast and stress-free experiences.

Powerful ML-driven Fraud Prevention: Seldon and Effectiv

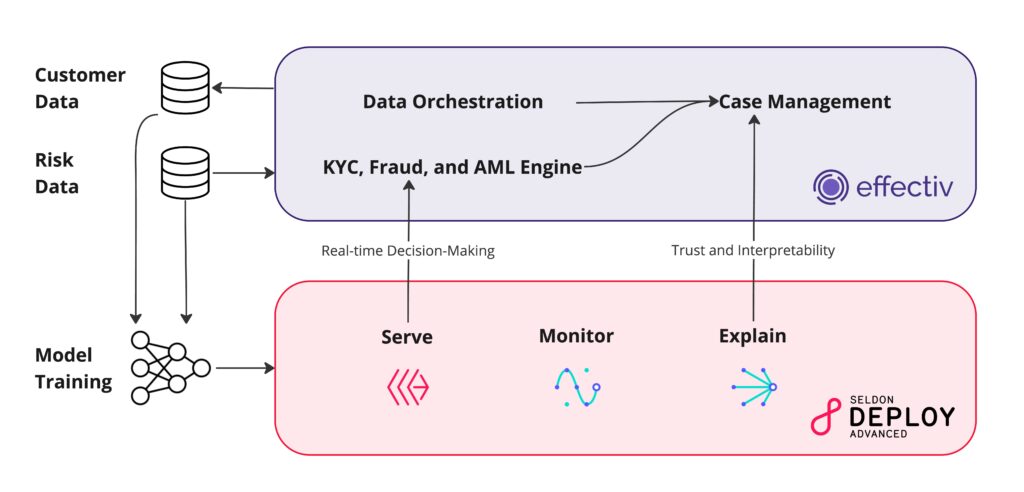

Effectiv and Seldon enable real-time decision-making for the financial services industry

Effectiv is an end-to-end fraud and risk management platform, enabling risk teams to manage sophisticated real-time fraud and anti-money laundering (AML) strategies by utilizing data and machine learning. Seldon is a deployment solution that helps teams serve, monitor, explain, and manage their ML models in production. Together, Seldon and Effectiv work hand-in-hand to enable financial institutions to adapt AI to prevent their institution and customers at scale by dramatically accelerating the development and deployment of real-time machine learning-driven fraud solutions.

Streamlining Model Development

Some of the most significant challenges the financial services industry faces to effectively utilize ML for fraud prevention have traditionally revolved around data orchestration and data consistency during both training and serving phases. This also extends to the computation of stateful risk features in real-time, which is critical for precise and effective fraud detection.

Effectiv’s no-code approach to building robust data pipelines capable of orchestrating interactions with third-party vendors is key to computing thousands of fraud features within millisecond latency. Model and pipeline versioning is another important concept for maintaining data and model governance.

In terms of providing training-ready datasets for data scientists, financial institutions should streamline the process of data preparation. It eliminates the time-consuming tasks of data cleaning and preprocessing, allowing data scientists to focus on the core task of model development and optimization.

Model Deployment and Management

Model deployment and management often pose significant challenges in the rapidly evolving field of machine learning. Simply serving a fraud detection model at scale requires extensive MLOps experience, and building monitoring solutions can consume valuable engineering resources.

MLServer offers an effective solution to these challenges. As an open-source inference server, MLServer facilitates the creation of REST and gRPC endpoints on top of serialized model artifacts, thus simplifying the deployment process. Any machine learning model can be Dockerized using MLServer and deployed conveniently.

To handle advanced requirements like inference graphs, A/B testing, and monitoring, Seldon Core comes into play. An open-source model orchestration framework, Seldon Core aids in deploying MLServer and Triton models at scale. It is built on Kubernetes, offering flexibility, scalability, and seamless integration with other platforms.

Seldon Deploy, an enterprise-grade solution, facilitates easy model deployment by data scientists, incorporating best practices such as monitoring, logging, drift detection, and alerts. This solution integrates with Effectiv, making it easier to serve models in a pre-integrated production pipeline. Importantly, Effectiv allows for easy model refreshing and updating, enabling adaptive decision-making without the need for additional engineering resources.

Model Adoption and Explainability

Model adoption and explainability have become significant focus areas in today’s machine-learning landscape. Financial institutions and regulatory bodies often require deep governance and an understanding of the decision-making processes behind ML models before they go into production. Furthermore, frontline staff and reviewers require a clear comprehension of these processes to ensure effective operation. The adoption rate of ML solutions that lack this level of trust and understanding is significantly lower.

Seldon’s XAI (Explainable Artificial Intelligence) solutions are the solution to these issues. Seldon Alibi provides numerous model interpretability techniques, enhancing the understanding and thus, the adoption rate of ML models. This explainability is key in fostering trust and confidence in the models and the decisions they drive.

Effectiv’s adaptable case management systems allow frontline staff and reviewers to consume model explainability during their investigation. This improves their comprehension of the ML-driven decision-making process and enables more informed and quicker decision-making.

Seldon Alibi SHAP explainer providing insights about a case in the Effectiv platform

Leveraging these tools to build and serve auditable and trustworthy models builds trust, facilitates understanding, and ultimately, increases the adoption rate of AI.

Envisioning the Future: A Holistic Approach

Looking ahead, the vision is to transcend the realm of fraud detection and consolidate all risk and fraud-related aspects into a single, comprehensive system. This approach necessitates more sophisticated model deployment, a challenge that combined solutions like Seldon and Effectiv can help solve.

In pursuit of a more sophisticated user experience, different functions within a financial institution will need to move closer together. Machine learning will need to power many decision frameworks in real-time which creates the need to utilize data collected from the entire user journey.

For this, a 360-degree view of customer data paired with advanced model serving is key. Integrating data from various customer touchpoints, such as onboarding, payments, account change events, and underwriting, can generate richer data sets. These comprehensive data sets are the foundation for improving machine learning models, leading to better prediction and detection of risk and fraud.

Ultimately, this holistic approach not only enhances the accuracy and efficiency of our risk and fraud management systems but also significantly improves the customer experience. By ensuring a safer environment for transactions, we build trust and loyalty with our customers, which is a key factor in overall business success.

Closing Thoughts

Seldon and Effectiv are changing the game in fraud prevention. By joining forces, they offer a powerful set of tools to help the financial services industry fight back against fraud. By creating a safer and more efficient environment for financial transactions, they’re helping to build trust and keep customers happy, paving the way for the financial institution of tomorrow.

This blog was co-authored by Jonathan Doering, Co-Founder and Head of Product at Effectiv and Andrew Wilson, Solutions Engineer at Seldon.