The strategic funding aims to expand Seldon’s machine learning product’s market fit and unlock enterprise-ready solutions based on open source

London, March 16, 2023 – Seldon, a data-centric machine learning operations (MLOps) platform for the deployment, management, monitoring and explainability of machine learning (ML) models, announced a $20M Series B funding round today. The round was led by new investor Bright Pixel (former Sonae IM) with significant participation from existing investors AlbionVC, Cambridge Innovation Capital, and Amadeus Capital Partners.

Organizations are investing heavily in AI but many are struggling to scale out their models in production due to bottlenecks in team workflows, increased regulation and compliance restraints, a lack of trust in model outputs, and ensuring peak model performance are all top of mind for AI-powered enterprises. Seldon empowers Data Scientists, ML Engineers and other business stakeholders to accelerate the adoption of machine learning to help solve these challenges with unprecedented efficiency.

“AI is in everything, and Seldon is uniquely positioned to ensure a return on ML investment by providing robust, scalable and secure infrastructure, pioneering a data-centric approach to ML pipelines, prioritizing team collaboration across the organization and making sure teams are able to solve meaningful problems at scale by building trust in machine learning, even under the most intense regulatory conditions. says Alex Housley, Seldon’s Founder and CEO. “We’re excited to bring together new investor Bright Pixel Capital and our existing partners, who believe in our vision and can help us become the trusted MLOps partner of any organization worldwide.”

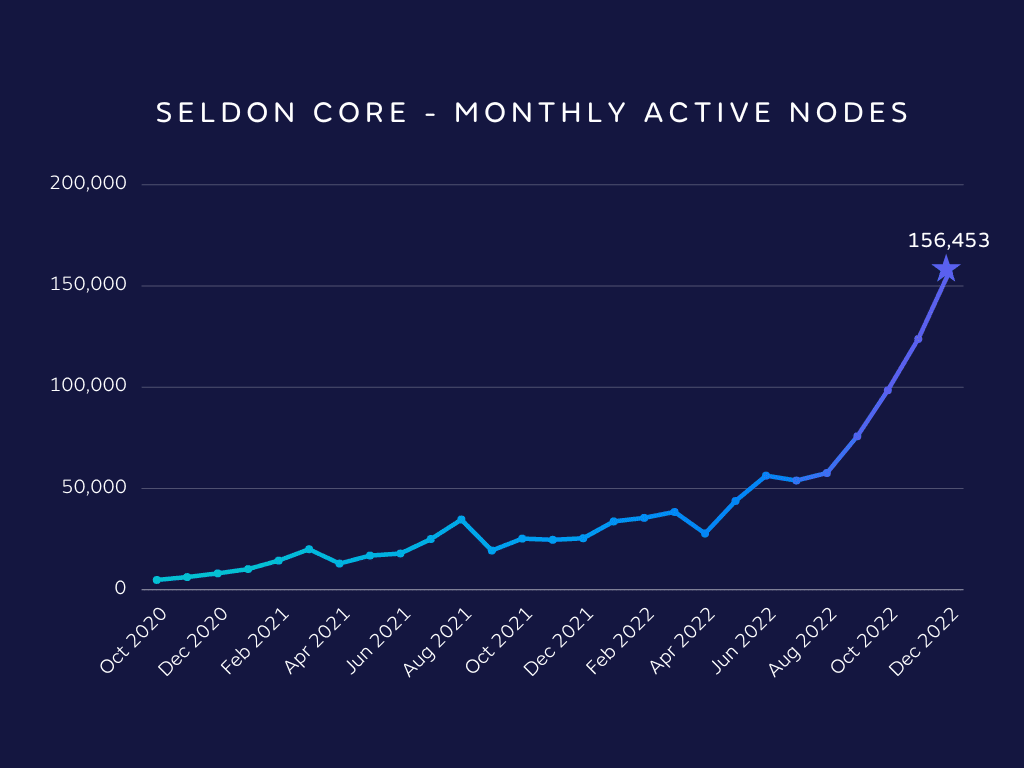

As a category leader in the MLOps space, the funding will be used to continue to pioneer a data-centric approach to AI across Seldon’s suite of products. Seldon has achieved a remarkable 400% YoY growth rate in its open source frameworks installed and running since its series A in November 2020. Seldon’s cutting-edge research, in collaboration with teams at Cambridge University, has been key to their innovative product development and is a central focus of the company following the raise. Seldon is also investing in customer success and strengthening the global support function.

“Seldon has differentiated itself by presenting a unique solution that is able to reduce the friction for users deploying and explaining ML models across any industry. This means more productivity for its clients, faster time-to-value combined with governance, risk and compliance capabilities. Its potential is invaluable,” says Pedro Carreira, Director at Bright Pixel. “We are proud to join Seldon’s team, as well as other investors, and help the company enter its next phase as a business.”

Seldon is powering the full production lifecycle in some of the biggest organizations worldwide. Current customers include PayPal, Johnson & Johnson, Audi and Experian, among others.

About Seldon

Seldon bridges the gap between data science and DevOps teams to bring models to market faster with more accuracy and minimized risk. Seldon transforms the process of deploying, monitoring, explaining and managing machine learning models at scale. Founded in 2014, Seldon has already helped to bring millions of unique ML models to production for hundreds of enterprises globally. Users report productivity gains of up to 92%, saving tens of millions of dollars on their machine learning projects.

About Bright Pixel

Bright Pixel, formerly known as Sonae IM, is a technology investment fund of the multinational group Sonae with special focus on cybersecurity, digital infrastructure, and retail technologies. It has a portfolio of more than 50 companies, from early to growth stages. Bright Pixel brings specialized know-how, global footprint, and a wealth of experience in helping companies from early stage to IPO. Find out more at brpx.com.